Study: Kentuckians voted against themselves on state-run social services vs. income tax

Plus, Ky Chamber says income tax rate prime lever in interstate migration

BEREA—Today, state legislators are back in Frankfort to set the Commonwealth's budget through 2028. The new session ends in mid-April.

All appropriations set by state lawmakers will be decided against the backdrop of dwindling funds gained from the individual state income tax, a mechanism that once helped to generate about 41% of the state's revenues. It's all thanks to a 2022 law written by state Republicans, that's set to phase out the income tax by 2032, even if there have been some tweaks here and there to accommodate a less aggressive schedule.

Meanwhile, a new study on what Kentuckians say are their highest priorities for Frankfort, suggests they consistently voted against their declared best interests when they elected, and re-elected, the current Republican supermajority into office. One policy analyst thinks these voting patterns directly undercut the very programs Kentuckians say they want.

"There's definitely a disconnect," said Jason Bailey, executive director of the nonprofit Kentucky Center for Economic Policy, headquartered in Berea. The Center sponsored the study survey, which was executed by the for-profit Change Research, headquartered in Washington, DC.

"I think a lot of people just don't know what really goes on in Frankfort. To the extent that people are tuning into issues, they tend to hear more about what's happening at the federal level. There tends to be more coverage of nations issues, not state."

Bailey made his comments during a phone interview with The Edge, following a webinar hosted by the Center on Monday. In addition to a presentation of the study data, the webinar detailed what Bailey described as the risks of eliminating the state income tax at a time when the federal burden of many services is being shifted to states, and when the economy seems to be weakening. About 200 people attended the online presentation.

In the aggregate, the survey findings illuminate an inconsistency between whom Kentuckians elect and what they declare they want their legislators to prioritize. Specifically, the data show that despite electing anti-tax Republicans, Kentuckians overwhelmingly support using taxation to fund a range of social programs.

'Tax the rich'

During the first week of December, the pollsters used social media and text messages sent to phone numbers on file with state voter files, to survey a random sample of 2,079 registered Kentucky voters as to whether elimination of the state income tax had directly benefitted them. Bailey said that most Kentuckians reported so far not feeling the impact of the state income tax elimination. Nine percent of respondents said the new tax law has helped them, about the same number (8%) said the law has harmed them, while 40% said they hadn't felt any benefit. The remaining 43% reported not having any sense of harm or benefit.

Change Research said the survey's margin of error was +/- 2.2%

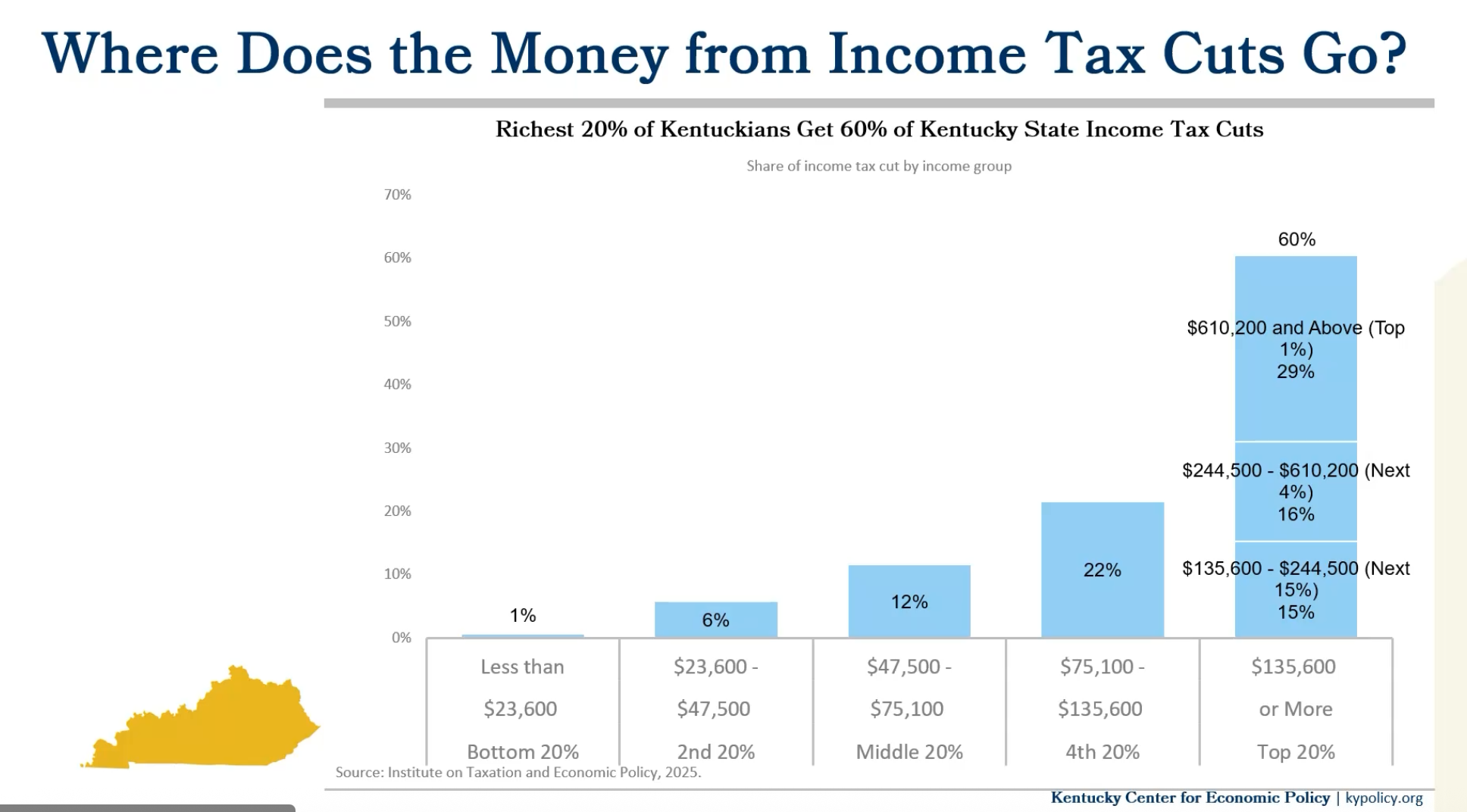

Bailey told the webinar audience these numbers reflect what he said is the phenomenon of tax cuts being for the wealthy, not the average citizen.

Respondents were also asked about how the state should cover its costs, and what they most wanted their legislators to focus on.

Less than a third (31%) of respondents endorsed cutting funding for schools, healthcare, and other public services, while over two-thirds (69%) endorsed generating more revenue by raising the income tax on the state's wealthiest citizens.

More than a quarter (28%) of those surveyed said they would like leaders in Frankfort to focus on reducing taxes for everyone, regardless of whether the wealthy would be the most to benefit. Nearly three-quarters (72%) said they would prefer to have leaders focus on improving public schools, access to healthcare, and on policies that address the sharp rise in the cost of living.

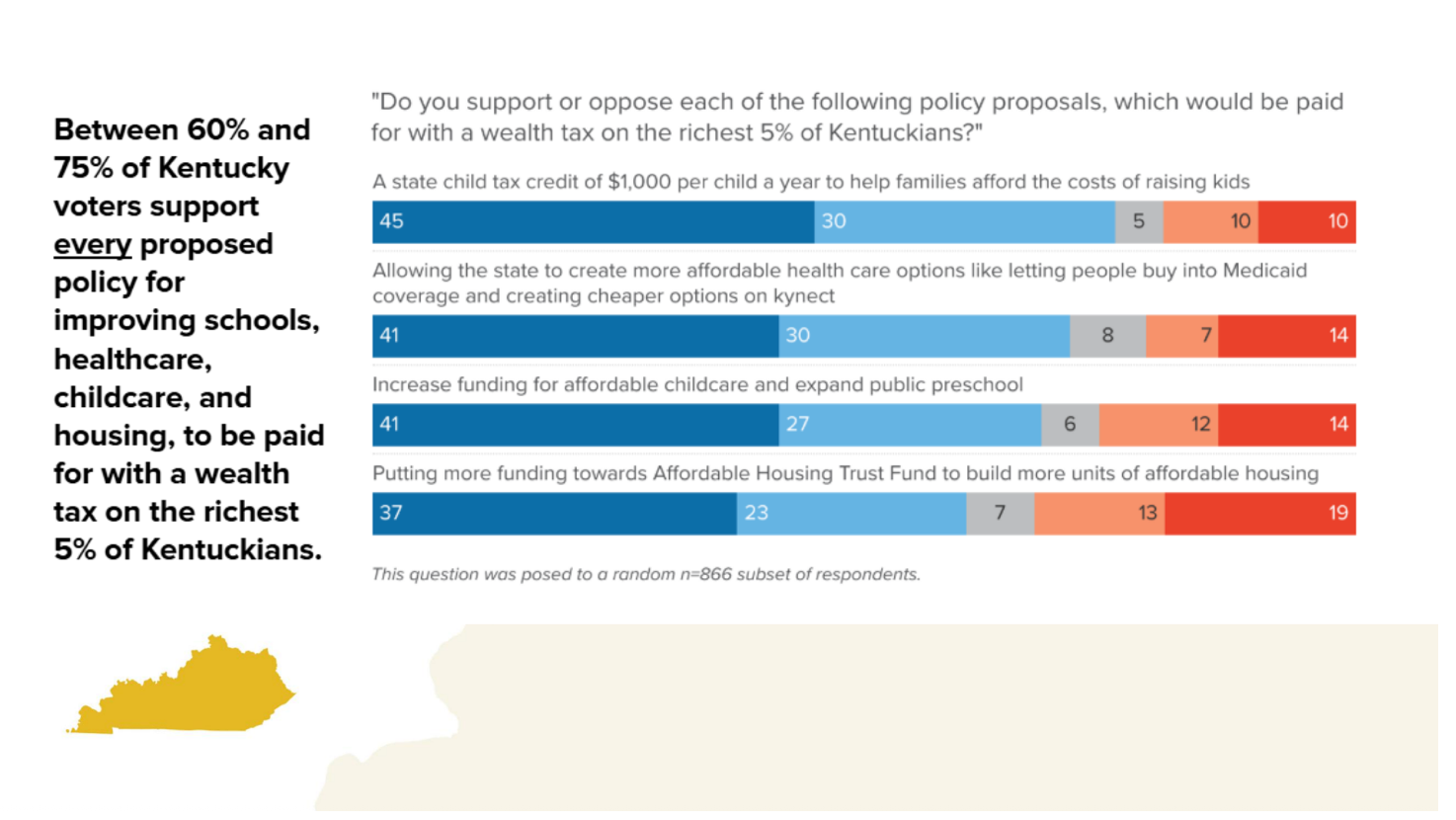

A randomly selected subset of respondents were asked whether they would support a range of policies to do with affordable housing, healthcare, and childcare. Between 60% and 75% endorsed all policies, and declared they should be funded by a wealth tax on the top 5% of the Commonwealth's richest people.

Further, a "settle up" tax on the top 5% wealthiest Kentuckians was endorsed by 67% of a second randomly selected subset of 891 survey takers. The tax should be applied to help improve social services in the state, according to those surveyed.

Bailey pointed out during the webinar that none of the policies endorsed by the survey takers are similarly endorsed by the current supermajority of Republicans in the General Assembly. In the state House of Representatives, 80 of the 100 seats are held by Republicans, while in the state Senate, Republicans hold 32 of 38 seats.

Half a point per year

The individual income tax elimination law, aka House Bill 8, was introduced, written, and sponsored by 15 Republicans from across the state in 2022. The law codifies their goal of decreasing the state income tax from 5% to 0% by 2032. They seek to reduce the rate by half a percentage point per each fiscal year. Currently, the state income tax rate is 3.5%. Legislation has since passed allowing there to be a cut at a lesser rate than half a percent when necessary. Last fiscal year, the state narrowly missed meeting the law's two criteria for another half a point.

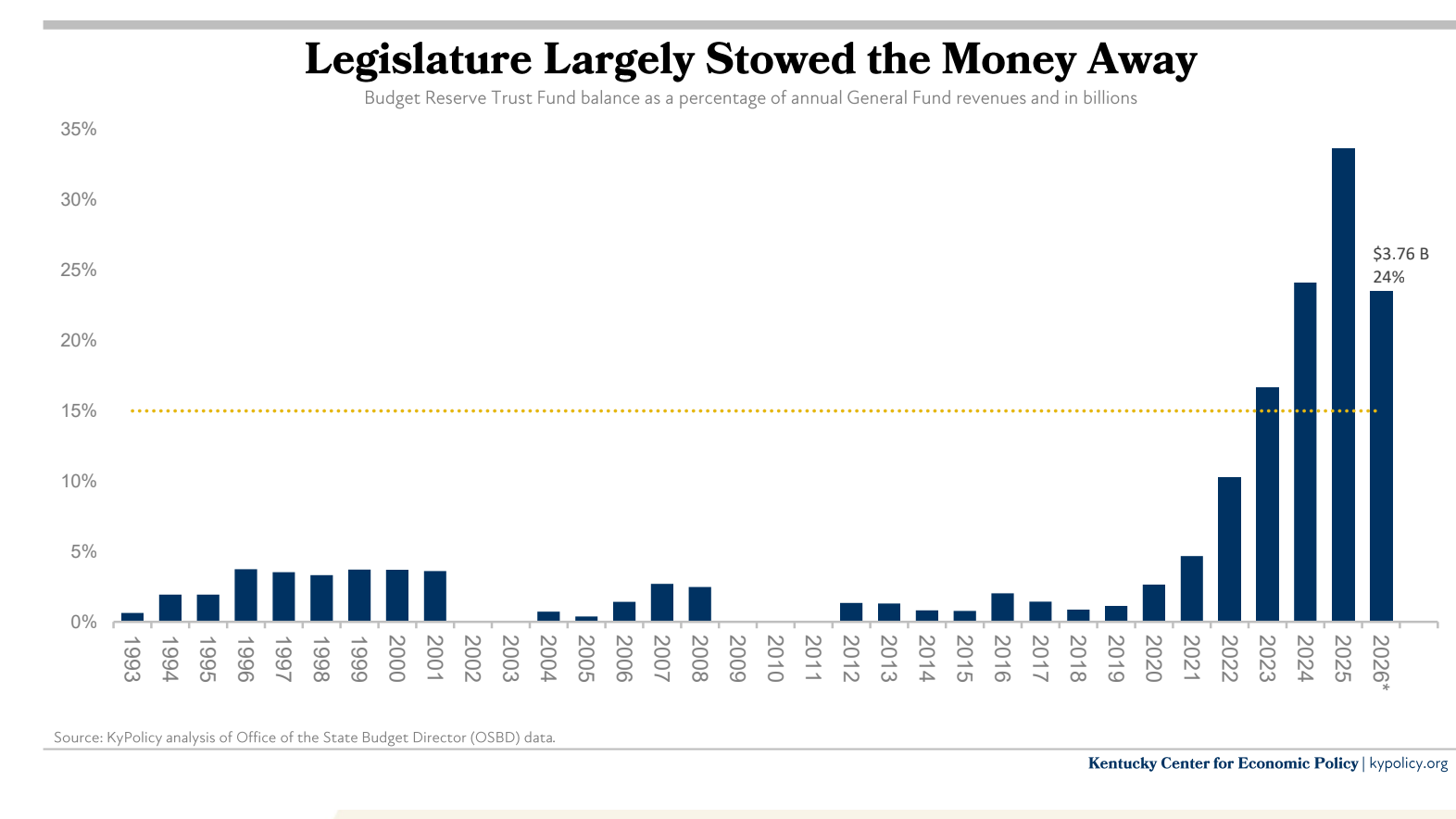

The first criteria is that the state's budget reserve trust fund must have been equal to or greater than 10% of general fund revenues for the preceding fiscal year. Second, that general fund revenues for that year must have exceeded general fund appropriations for the preceding fiscal year by an amount equivalent to a one percentage point reduction in the income tax rate for that year.

Put simply, if the state can show it spends less than it takes in by a certain amount each year, then the income tax rate will be reduced until it is gone entirely.

For the past two years, the state budget has been just over $14 billion, with revenues hovering around $15 billion. However, late last year, Gov. Andy Beshear's office sought to revise down the state revenues for the most recent fiscal year by about $156 million. Beshear is expected to address the discrepancy during his State of the Commonwealth address on Wednesday.

Once it's gone, it's gone

For Bailey, the Republican calculus is risky.

"The goal of eliminating the income tax is really expensive," he told The Edge in the interview. "It gets more expensive the more they cut it. That's why they are trying to backstop the eventual shortfalls."

Bailey is referring to the spike in the amount legislators have been allocating from the state's budget reserve trust fund to the general fund since the Republican Supermajority took hold in 2012. Last year, more than a third of the state budget reserve trust fund balance was placed in the state's general fund.

Republicans can backstop the general fund all they want, according to Bailey, but in the end, once the fund is drained there's nothing to replenish it. "That's one-time money. The tax cuts are permanent," he said in the interview.

Weakening economy

Bailey outlined a choice for state Republican leaders. Either they reverse their drive to eliminate the state income tax, or they risk lowering the quality of life for a large number of Kentuckians. For evidence of this, Bailey pointed to another report issued by the Center.

"[U]nlike recent years, when pandemic-era stimulus created robust revenue growth, lawmakers are now facing a serious budget crunch due to the loss of federal funds, a weakening economy and falling revenue because of state income tax cuts," the report reads.

Citing federal data, the Center claims in the report that the rate of new job creation and economic confidence are declining nationally, largely due to the impact of tariffs and current immigration policies. The report also blames "high and fluctuating" tariffs for causing companies to fear investing at the moment, slowing down production and putting a chill on job growth, and says that since the state has underfunded social services since the recession of 2008, Kentucky already has a weakened social safety net.

While the report credits the high reserve of funds legislators have socked away into the general fund that could be used to plug any holes in the budget, it warns that "additional tax cuts in the upcoming session, including if lawmakers conform to new federal tax cuts in their own tax code, would further weaken the state’s position."

In the webinar, Bailey added that the passage of Trump's "One Big Beautiful Bill" into law last summer will cut social services enough to place more pressure than ever on the state's capacity to fund its healthcare and nutrition assistance programs. Plus, said Bailey, the state will now be expected to shoulder the $64 million dollar administrative cost for state Medicaid recipients, previously covered by the federal government.

Bailey said that Kentucky loses $718 million per each half a percentage point cut to the state income tax, money he said could instead be invested in improving education services. Per district, if that money were applied to public education, he said teachers could see as much as an 8% raise, combatting the state's poor teacher retention levels and its consistently low rankings nationally in average teacher starting salaries.

Income tax 'drives interstate migration'

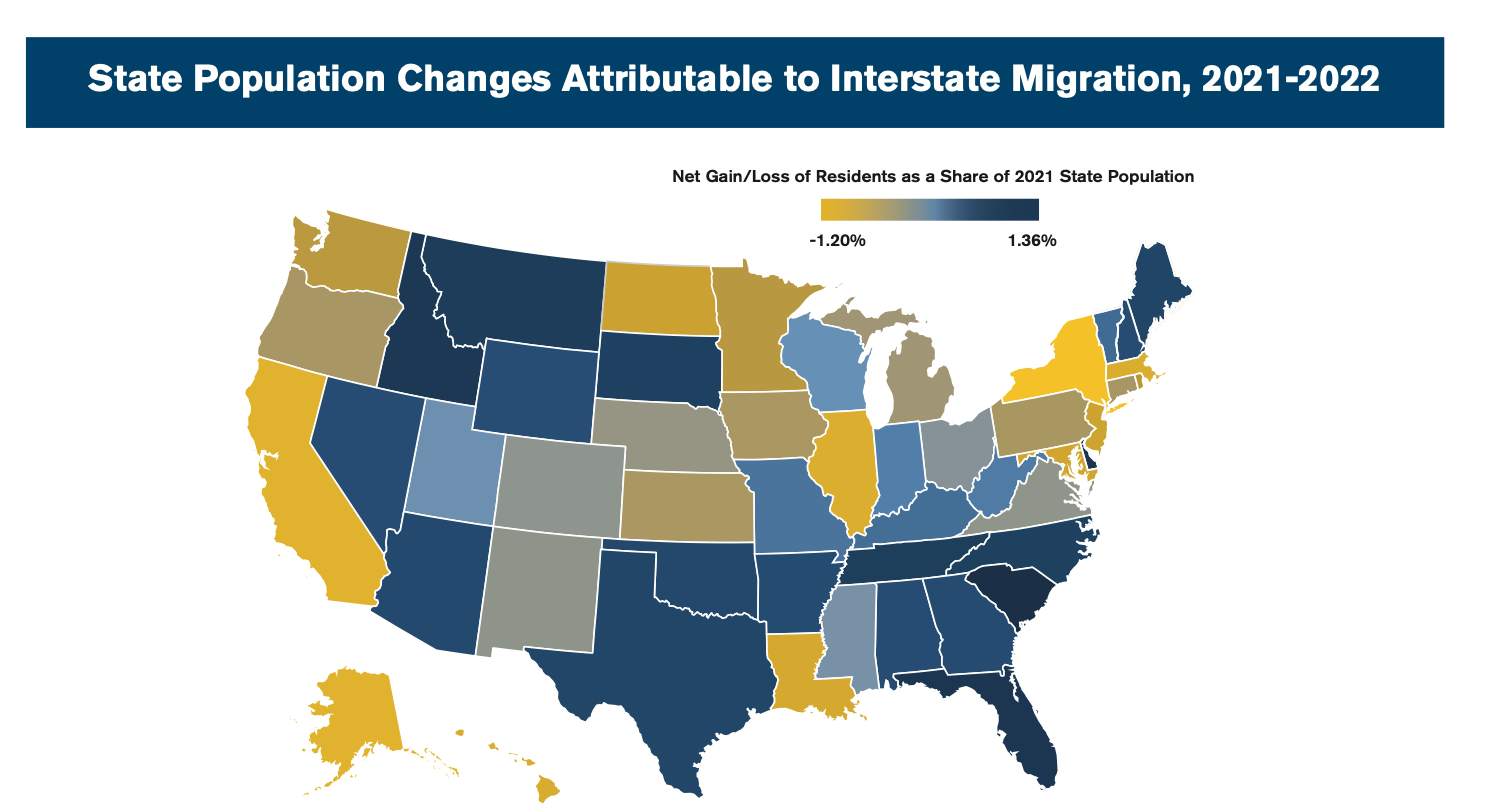

There are consequences for not dropping the income tax, however, according to some. The Kentucky Chamber of Commerce recently issued a report that shows how high state income tax policies are driving interstate migration.

In recent years, states with the highest income tax rates have seen greater levels of migration to states with no or low state income tax rates, according to the Chamber's report. It cites a study of the impact California's 13.3% income tax – the nation's highest – has had on out-of-state migration. The study found that California's highest earners moved to low- or no-tax jurisdictions, taking a net $11 billion of taxable income with them.

The report claimed that of the 10 states that experienced the largest gains due to the inflow of new arrivals from states with higher income tax rates, four do not levy any income tax. Eight of the top ten tax-refugee destination states either have no income tax, have a flat income tax, or are moving to a flat income tax.

The report thus argues "state taxes on production and individual income are more economically disruptive and less efficient than state sales taxes that are neutrally and transparently levied on individual consumption and spending."

“Tax reform is the Kentucky Chamber’s top legislative priority, and we remain fully committed to phasing out Kentucky’s individual income tax because of the positive impacts this policy would have on long-term economic growth in our state," the Chamber's vice president for policy, Charles Aull, PhD, told The Edge in an email. The Chamber's position remains resolute, according to Aull, even in the face of increased state financial responsibility thanks to new federal law.

"The legislature has established a careful process for gradually reducing the individual income tax rate that is based on economic growth and careful budgeting. We continue to advocate for this approach and look forward to working with lawmakers to ensure that Kentucky’s tax code is economically competitive,” Aull said in the email.

So far, the data on whether Kentucky's income tax status is competitive are fairly neutral. The Lexington Herald-Leader has reported that Kentucky lost about 93,000 residents to other states in 2023, many of them to same low- and no-income tax states attracting California such as Florida and Texas. But Kentuckians are also moving to North Carolina and New York where the respective state income tax rates are higher than in the Bluegrass state, according to the report.

Meanwhile, Kentucky seems to have largely balanced the number of Kentuckians leaving the state with a similar number of incoming residents from other states. In 2024, US census community survey data showed just under 96,000 persons moved to Kentucky from elsewhere in the US.

As possible modifications to the current income tax elimination law are expected to figure in this year's legislative session, and you find you have an opinion you'd like to share with your state legislators, visit this directory for more information.

This story has been updated in order to correct the name of the Lexington Herald-Leader. The word "Leader" was missing previously.